Optimizing Business Operations: Payroll Control Center (PCC) for Efficient Payroll Processing

Introduction

Payroll is a critical, high-stakes function for every organization—but it’s also one that is notoriously time-sensitive and error-prone. From managing last-minute changes to ensuring every run complies with regional tax regulations, payroll teams constantly operate under pressure. Manual interventions, data mismatches, and compliance violations can lead to delays, audits, or worse—loss of employee trust.

Enter the SAP Payroll Control Center (PCC)—a game-changing solution that transforms how payroll is executed, validated, and monitored. At Integritty, we’ve helped leading organizations leverage PCC to reduce manual workload, enhancereal-time visibility, and drive payroll precision.

This blog explores how PCC works, what value it brings to your payroll function, and how Integritty configures it to unlock its full potential.

The Problem with Traditional Payroll Processing

Most legacy payroll systems are heavily reliant on batch processing and post-payroll audits. This reactive approach creates major inefficiencies:

- Limited real-time visibility: Issues only surface after payroll is processed.

- Manual validations: Teams spend hours cross-checking errors with spreadsheets.

- Compliance gaps: Detecting policy violations or regulatory risks is often delayed.

- Overreliance on individual knowledge: Troubleshooting payroll problems depends heavily on payroll experts familiar with system quirks.

In short, teams are firefighting—rather than focusing on payroll strategy or improving the employee experience.

What is the SAP Payroll Control Center?

The SAP Payroll Control Center (PCC) is an integrated framework that makes payroll processing proactive, automated, and insight driven. It provides a single cockpit where payroll managers and administrators can monitor, validate, and approve payroll runs—all within a simplified UI.

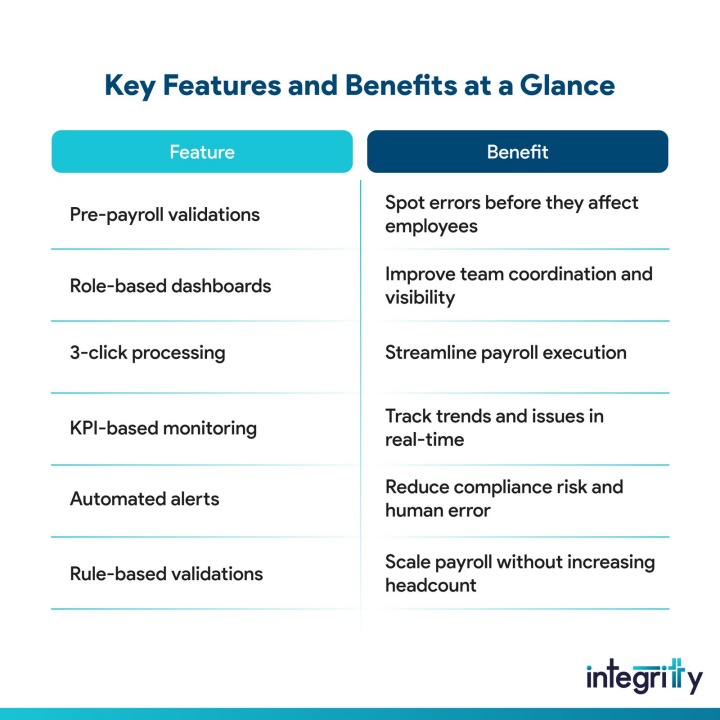

Unlike traditional methods, PCC introduces:

- Pre-payroll validations: Spot and fix issues before finalizing payroll.

- Real-time KPIs: Track anomalies, missing data, or compliance risks on the fly.

- Role-based access: Enable collaborative workflows across HR, payroll, and finance.

PCC is designed for modern organizations seeking accuracy, efficiency, and compliance from their payroll function.

Integritty’s PCC Implementation Approach

At Integritty, we’ve developed a proven methodology to implement PCC for SAP Payroll—whether it’s on-premises, hosted in SAP BTP, or integrated with Employee Central Payroll (ECP). Here’s how we help customers optimize operations:

1. 3-Click Payroll Processing

We streamline and simplify payroll execution into just three core steps—Preparation, Validation, and Finalization. Once setup, payroll teams can run payrollthrough a guided process that minimizes errors and reduces runtime complexities.

Outcome: Less manual effort, standardized payroll steps, and faster payroll closure.

2. Real-Time Alerts and KPIs

Using SAP’s inbuilt analytics and rule-based engines, we configure personalized dashboards to track:

- Employees with missing banking info

- Overtime inconsistencies

- Taxation anomalies

- Retroactive changes

PCC continuously monitors data and generates live alerts. KPIs can be aligned with organizational thresholds, giving payroll managers real-time insight into process health.

Outcome: Issues are identified and resolved before payroll is run, ensuring accuracy and compliance.

3. Automated Validation Checks

We help businesses configure hundreds of automated validation rules tailored to their workforce, legal entities, and locations. These checks identify:

- Invalid master data entries

- Incomplete time recording

- Tax code mismatches

- Wage type duplications

You don’t need to manually scan reports—PCC flags discrepancies in advance, significantly reducing corrections post-payroll.

Outcome: Lower error rates and improved data quality.

4. Error Ownership and Collaboration

PCC promotes transparency and collaboration by assigning issues to specific stakeholders. Integritty enables integration with workflows, so HR, payroll, and operations teams can collectively fix problems in real time.

Outcome: Fewer delays due to cross-team silos or unclear accountability.

A Glimpse into the PCC Workflow

Why PCC is a Strategic Advantage

SAP Payroll Control Center isn’t just a process optimization tool—it’s a strategy shift. It frees up payroll professionals from tactical execution so they can focus on:

- Payroll analytics and forecasting

- Enhancing employee experience

- Policy alignment and audit readiness

- Business continuity and risk reduction

The key to success is aligning the payroll function with digital transformation goals—and PCC is the bridge.

Final Thoughts

In today’s digital HR ecosystem, accuracy and speed are no longer trade-offs—they’re expected outcomes. By implementing SAP Payroll Control Center, you shift payroll from reactive processing to strategic performance.

At Integritty, we’ve helped global enterprises successfully adopt PCC, bringing structure, intelligence, and peace of mind to one of the most critical HR operations

Want to experience PCC for your organization?

Explore our SAP Payroll implementation expertise.